Looks like there's a key difference here: Rabo needs you to increase the balance while UBank only to deposit (and you can even lower the balance overall and still get the high %).The link has reference to the following "Premium Saving" account.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

UBank is "enhancing" their savings account - Where to now?

- Thread starter tdimdad

- Start date

- Joined

- Nov 16, 2004

- Posts

- 47,554

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- SkyTeam

- Elite Plus

That was more in relation to the availability of 5.45% interest rather than how to do it.Looks like there's a key difference here: Rabo needs you to increase the balance while UBank only to deposit (and you can even lower the balance overall and still get the high %).

We've been using ING where to get 5.5% you need to deposit $1K and do 5 EFTPOS each month as well as increase the balance.

I increase my ING balance by 1c (plus interest) each month. Same with ME Bank.That was more in relation to the availability of 5.45% interest rather than how to do it.

We've been using ING where to get 5.5% you need to deposit $1K and do 5 EFTPOS each month as well as increase the balance.

luckypierre

Member

- Joined

- Feb 20, 2009

- Posts

- 322

- Qantas

- Qantas Club

- Virgin

- Platinum

And that’s the issue with some of these accounts, it’s a PITA. I’ll need to have another look at ME though , we ditched them some time ago because they became less competitive. The banks make you work for your interest $$$.and do 5 EFTPOS each month

I split my transaction when shopping at Coles and pay the dollar amount with a discounted gift card and the cents with my ING card. I go at least twice a week so tend to get my 5 transactions done in the first half of the month.And that’s the issue with some of these accounts, it’s a PITA. I’ll need to have another look at ME though , we ditched them some time ago because they became less competitive. The banks make you work for your interest $$$.

luckypierre

Member

- Joined

- Feb 20, 2009

- Posts

- 322

- Qantas

- Qantas Club

- Virgin

- Platinum

Have done similar myself previously, the self checkouts helpful in that respect. How do you go if travelling OS ? Assume you can still make your 5 EFTPOS transactions per month OS?I split my transaction when shopping at Coles and pay the dollar amount with a discounted gift card and the cents with my ING card. I go at least twice a week so tend to get my 5 transactions done in the first half of the month.

I either use it for small OS transactions or use my mobile to pay for bills using PayPal and split the transaction putting a little on the ING card.Have done similar myself previously, the self checkouts helpful in that respect. How do you go if travelling OS ? Assume you can still make your 5 EFTPOS transactions per month OS?

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 10,646

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

For someone who chucks most things on a fee free CC when OS (and forgo FF pts), it doesn’t matter if they’re big or small transactions. A beer, a coffee or even 20p to pee…all count towards the 5x transactions.I either use it for small OS transactions or use my mobile to pay for bills using PayPal and split the transaction putting a little on the ING card.

pauly7

Senior Member

- Joined

- Dec 8, 2004

- Posts

- 5,370

And that’s the issue with some of these accounts, it’s a PITA. I’ll need to have another look at ME though , we ditched them some time ago because they became less competitive. The banks make you work for your interest $$$.

Agree. And eftpos?

For some who have more time on their hands I can see it being worth the leg work but certainly not for others!

luckypierre

Member

- Joined

- Feb 20, 2009

- Posts

- 322

- Qantas

- Qantas Club

- Virgin

- Platinum

Fair enough, but the 5.55% is on balances up to 100k then drops to 3.0% 100k-1000k.I prefer ME Bank HomeMe Saver (5.55%). Sure I need to deposit $2000 into the ME Spend account, but I transfer it straight out. The HomeMe Saver account has to grow (excluding interest), but I just ensure that at the end of the month it is 1c more than on the 1st of the month.

If you move money when you hit 100k balance you don’t comply with the grow the balance requirement to attain the bonus interest for that month.

I've got less than 100k in the account.Fair enough, but the 5.55% is on balances up to 100k then drops to 3.0% 100k-1000k.

If you move money when you hit 100k balance you don’t comply with the grow the balance requirement to attain the bonus interest for that month.

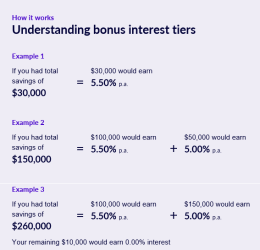

The UBank interest rate tiers are out.

The first $100k earns 5.50%, the next $150k earns 5.00%. Anything above $250k gets nothing.

Better than now for smaller balances.

Their page lists the tiers but not the rates (they were in an email I got today). Hopefully the rates will be published soon, as well.

www.ubank.com.au

www.ubank.com.au

The first $100k earns 5.50%, the next $150k earns 5.00%. Anything above $250k gets nothing.

Better than now for smaller balances.

Their page lists the tiers but not the rates (they were in an email I got today). Hopefully the rates will be published soon, as well.

Changes to Save accounts - ubank

We’re introducing new bonus interest tiers, bonus rate criteria and changing some functions of Save accounts. Find out more

DejaBrew

Established Member

- Joined

- Jul 8, 2007

- Posts

- 1,225

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

And way less hassle than others.So UBank have increased their rate to 5.5% to match ING but now up to $100k then 5%. Which is better than ING.

luckypierre

Member

- Joined

- Feb 20, 2009

- Posts

- 322

- Qantas

- Qantas Club

- Virgin

- Platinum

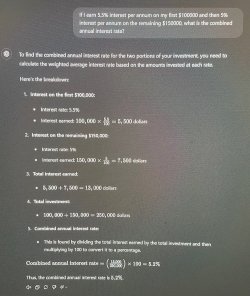

If my maths is correct it effectively equates to 5.2% interest to 250kRates are published. Need to deposit $500 per calendar month:

View attachment 391353

DejaBrew

Established Member

- Joined

- Jul 8, 2007

- Posts

- 1,225

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

I really wanted to be able to say “not so @luckypierre *”, but ChatGPT concursIf my maths is correct it effectively equates to 5.2% interest to 250k

* Do we have any “History of the World” fans in the house?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.